-

Put Your Money To Work....

While You SleepInvest for your Family's Future with the help of our experienced team

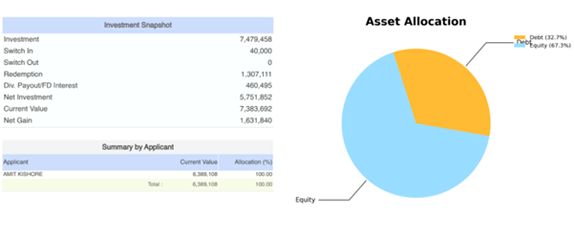

Achieve Your Goals

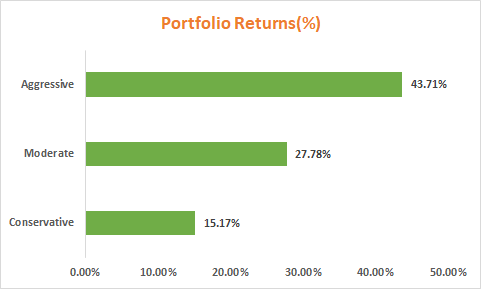

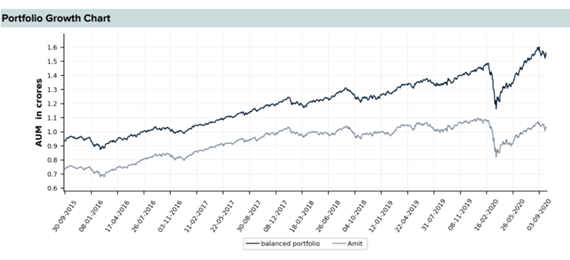

* Annualised actual portfolio returns (IRR) of CIO's portfolio

* Inception Date: Nov'19

- Aggressive Portfolio: 100% Equity

- Moderate: Equity 50% I Fixed Income: 35% I Alternatives: 15%

- Conservative: Equity: 20% I Fixed Income : 70% I Alternatives : 10%

Our Chief Investment Officer is an astute investment professional, who has extensive experience of working with HNIs, families, foundations, and corporations to build diversified, multi asset class portfolios as per clients’ overall needs.

He has managed a total portfolio size of more than USD 1 Bn (INR 7500 Cr) across various organisations and helped clients achieve their goals including inter generation wealth transfer through family trusts and wills.

The Chief Investment Officer is a Chartered Accountant and CFP® professional. He also holds Msc in Wealth Management from the Singapore Management University, Specialisation in Asset Management from the Yale Business School USA , and Specialisation in Family Office Wealth Management from the University of St Gallen, Switzerland.

Please write to us for booking a free portfolio review call with our CIO by uploading your Consolidated account statement.

Our Investment Philosophy

Risk Assessment

We work with you to understand your Level of Acceptable Risk to determine an appropriate strategic asset allocation

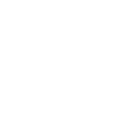

Asset Allocation

Asset Selection

Performance Reporting

Digital Adoption

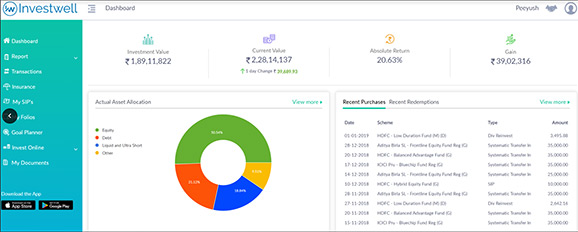

New Invest

Folio Lookup

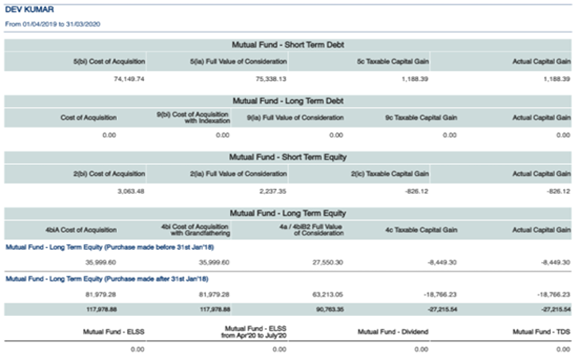

Capital Gain

Unrealised Gain

24X7 Portfolio View

My SIP

My Orders

Risk Profile

Latest Post

5 Reasons you need a Financial Advisor

Health is wealth. Good health is not just the absence of any illness, but complete physical and mental wellness of…

7 bonus ideas you need in your life!

It’s the end of another financial year, and many of you will be receiving your annual performance bonus. Exciting time,…

Breaking Down Debt Mutual Funds

Debt mutual funds are those that invest in fixed income instruments – such as corporate and government bonds

Testimonials

Thanks to the guidance and support provided by Coinfit Financial Services, I have witnessed significant progress in achieving my financial goals. I am confident that with their ongoing support, I will continue to build a secure and prosperous financial future.

Sahil Kumar Doctor

As someone who has always been cautious about financial matters, I was looking for a trustworthy and knowledgeable partner to help me navigate the complexities of wealth management. I am delighted to say that I found exactly what I was searching for.

Suraj Verma Lawyer